As industry consolidation continues, we can expect a number of mergers and acquisitions (M&As) in the next several months, but the first M&A story of 2016 is a whopper. This week, Johnson Controls and Tyco have announced their merger into one company with annual revenue of $32 billion. The new Johnson Controls will be almost a direct reflection of one of the industry’s biggest trends – the move toward technology convergence and smart buildings.

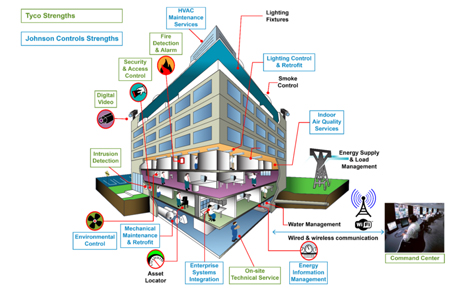

Johnson Controls has previously had a small presence in the physical security market, but their products have mostly centred around building controls, HVAC and energy storage technology. For its part, Tyco’s focus on video, access control and alarm systems has expanded to consider those systems in the context of broader building systems. The trend toward convergence in the building market is the common ground for these companies, and a major driver in their decision to merge.

The combined company, Johnson Controls plc, will provide products, installation and service capabilities across controls, fire, security, HVAC and power solutions.

Combined resources and territories for strong ‘global footprints’

“Tyco no longer sees its market as limited to the fire and security industry when developing new products and services,” says George Oliver, Tyco CEO. “In the long term, this transaction allows us to more completely address the total customer need and to combine Johnson Controls’ strong product portfolio with our resources, devices and in the field to create solutions to better solve customers’ problems.” He says both companies offer “robust innovation pipelines and extensive global footprints.”

Those global footprints are also complementary. For example, Tyco is very strong in Europe, while Johnson Controls has more presence in Asia; the combined company will therefore have both areas covered, and both are strong in the United States. Both companies have also worked to standardise and simplify their products, which will promote easier integration to combine their capabilities.

The combined company will be headquartered at Tyco’s current global headquarters in Cork, Ireland. U.S. headquarters will be at Johnson Controls’ current location in Milwaukee. The merger is expected to be complete by the end of fiscal 2016. (In 2017, the combined companies will “spin off” a Johnson Controls division that manufactures automotive seats.)

|

| Click here for larger image The combined strengths and specialised areas of Johnson Controls and Tyco will allow them to deliver integrated systems for smart buildings in the future |

Smart buildings & technology convergence trends

“Convergence of fire and security with building controls and HVAC creates a much greater value proposition,” Oliver notes. “We can capitalise on the trend toward smart buildings.” The connectivity trend includes homes, buildings and cities. Markets include large institutions, commercial buildings, retail, industrial, small business and residential.

“There is true convergence of technology taking place,” he adds. “When you look at the total customer problem, and the ability to create new business models to support customers, create value and accelerate growth, there isn’t a better combination [than Tyco and Johnson Controls.] The foundation of the deal is a great strategic fit, and being able to capitalize on the growth opportunity we see going forward.”

The companies’ product offerings reflect how both companies have been working toward smarter buildings. Johnson Controls’ Metasys intelligent Building Automation System connects HVAC, lighting, security and protection systems, enabling them to communicate on a single platform to enable smarter decision-making. Tyco has developed the TycoOn cloud-based system to collect data from various sensors and to configure the data and apply analytics.

Integrators going beyond physical security

In addition to lowering costs, combining the two companies’ technologies will provide more opportunities from “Big Data” and the “Internet of Things” – including the ability to monitor equipment and analyse trends for customers.

Beyond positioning the new company well in the building market, the merger will provide $500 million in “cost synergies,” not to mention $150 million in tax savings, according to the companies.

Many end users now view their physical security and fire systems in the broader environment of their building systems, and even integrator/installers are expanding their view beyond a narrow focus on video cameras and access control. Smart buildings are a big trend, and an opportunity that more and more companies will be looking to capitalise on. The new Johnson Controls (incorporating what we now know as Tyco) will be well-positioned to succeed in that market.

It’s also a new chapter for some of the most well-known brands in the physical security market – such as American Dynamics, Software House, Exacq Technologies and SimplexGrinnell. They’ll be finding their place in the world of smart buildings, too.