As an Indian multinational public sector bank, this financial services entity plays a crucial role in bolstering India’s economy and addressing the diverse needs of its vast customer base.

In the United Kingdom, this institution has been active since the early 1900s, gradually growing to become the largest Indian bank in the UK. Initially, its focus in the UK market was on wholesale banking, but it has since expanded its offerings to include a dedicated retail arm.

Financial products and services

Operating 11 branches across the UK, it provides a wide range of financial products and services tailored to both commercial and individual clients.

These include commercial lending, buy-to-let mortgages, cash ISAs, safe deposit lockers, instant access savings accounts, business accounts, and fixed deposits.

Overview

The institution faced operational inefficiencies and security concerns due to maintaining separate software

Confronted with the challenge of integrating attendance and payroll software, along with the inability to effectively restrict unauthorised access to its secured premises across 14 locations, a prominent financial institution sought a comprehensive multi-location solution.

Additionally, the institution faced operational inefficiencies and security concerns due to maintaining separate software platforms for employee directories.

Need for a cloud-based attendance system

To address these issues, the institution sought an integrated cloud-based attendance system that seamlessly integrates with payroll, enhances access control measures, and consolidates employee directory management.

This solution aimed to ensure streamlined operations and heightened security across its premises.

Institution's challenge

The challenges centered around implementing a cloud-based attendance system and access management processes, as detailed below:

- Need for Integrated Attendance and Payroll Software

The financial institution faced difficulties managing attendance and payroll software separately, resulting in inefficiencies and potential discrepancies in salary processing.

There was an urgent need to integrate these systems to ensure seamless data flow and improve payroll management.

- Inadequate Entry and Exit Security Measures

The institution struggled to restrict unauthorised entry and exit into its secured premises, posing significant security risks.

Strengthening access control measures was essential to mitigate the threat of unauthorised access and protect personnel and assets.

- Need for a Single Employee Directory

Using different software for employee directories created complexity and inefficiency

Using different software for employee directories created complexity and inefficiency in administrative processes.

It was crucial to consolidate employee directory management into a single platform to ensure accurate, consistent, and easily accessible employee information.

- Need for a Dedicated Server to Safeguard Data Integrity and Compliance

The client had stringent requirements regarding data usage, with a key stipulation being that their main servers could not be used to manage third-party applications. This necessitated the implementation of a separate server or a cloud-based attendance system to host third-party applications and services, ensuring strict data protection measures and compliance with relevant regulations.

These challenges highlighted the need for comprehensive solutions to improve operational efficiency, security, and data management within the financial institution.

Matrix solution

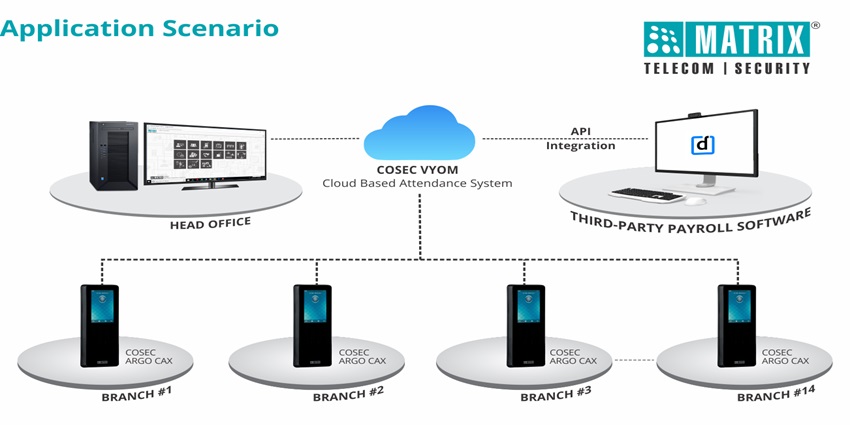

To tackle the challenges faced by the financial institution, Matrix delivered comprehensive solutions, including a cloud-based attendance system that transformed its attendance management processes:

- Integration of Events and Payroll Software:

Matrix seamlessly merged the institution's event logs and payroll software, Darwin Box, through API Integration, guaranteeing synchronised data flow.

Through this consolidation, Matrix facilitated smooth payroll processing, lessening inefficiencies, and decreasing the likelihood of discrepancies in salary management.

- Enhancement of Entry and Exit Security Measures:

Utilising advanced technology, Matrix enhanced security protocols, reducing potential risks

Matrix deployed proactive access control measures to strengthen the institution's premises against unauthorised entry and exit.

Utilising advanced technology, Matrix enhanced security protocols, reducing potential risks and effectively protecting personnel and assets.

- Unified Employee Directory Management:

Matrix unified the institution's management of employee directories by offering a centralised platform.

By consolidating employee data, Matrix optimised the system so that updates made in the payroll software would automatically synchronise with the COSEC software, ensuring precise, uniform, and easily accessible vital employee information.

- Implementation of Cloud-based Solution:

Due to a strict restriction on using the COSEC application on their primary server, Matrix proposed and implemented COSEC VYOM, a cloud-based attendance system tailored to their requirements.

Moreover, this system was seamlessly linked with their payroll system through API Integration.

Results observed

Matrix's comprehensive solutions brought significant enhancements across various facets of the financial institution's operations, yielding measurable improvements in efficiency, security, and compliance:

- Efficient Payroll Processing:

By integrating event logs and payroll software, Matrix facilitated seamless data flow and streamlined payroll

By integrating event logs and payroll software, Matrix facilitated seamless data flow and streamlined payroll processing.

This consolidation minimised inefficiencies and reduced discrepancies in salary management, causing more accurate and efficient payroll operations.

- Improved Premises Security:

Matrix's proactive implementation of access control technology, Matrix fortified entry and exit points, mitigating security risks, and effectively safeguarding personnel and assets.

- Centralised Employee Directory Management:

Through a unified platform for employee directory management, Matrix streamlined administrative processes and ensured consistency and accuracy in employee data.

Changes made in the COSEC application automatically updated the payroll software, reducing manual effort and error.

- Compliance with Data Protection Regulations via Cloud-Based Attendance System:

Matrix's provision of COSEC VYOM, a cloud-based attendance system, helped ensure compliance with strict data protection requirements.

By segregating data and applications, Matrix improved data integrity and ensured adherence to regulations, minimising the risk of data breaches and non-compliance penalties.

Operational efficiency, security, compliance

Matrix's solutions not only tackled the financial institution's challenges but also delivered tangible enhancements

In summary, Matrix's solutions not only tackled the financial institution's challenges but also delivered tangible enhancements in operational efficiency, security, compliance, and data management.

Matrix contributed to the institution's effectiveness and resilience in the financial sector through integrated systems and innovative solutions.

Products offered

- COSEC ARGO CAM200: MiFare Classic Card-Based Ultra Fast Door Controller

- COSEC VYOM TENANT: Tenant User Licence

- COSEC VYOM PLATFORM UD10K: Cloud-based Platform User Licence for 10K User Days

- COSEC VYOM PLATFORM UD100K: Cloud-based Platform User Licence for 100K User Days

From facial recognition to LiDAR, explore the innovations redefining gaming surveillance