Ken Sutherland of Telindus Surveillance Solutions discusses the growth of networked video surveillance over the past ten years and whether the security industry is now ready for this change.

Ken Sutherland of Telindus Surveillance Solutions discusses the growth of networked video surveillance over the past ten years and whether the security industry is now ready for this change.

Some of the early pioneering companies in the video over IP market are approaching their 10-year anniversaries, but few of them are profitable yet. Most of these companies became involved in this market by inventing some video encoding technology and then trying to find an application for that technology, but this does not mean that the market will automatically adopt that technology.

There is no doubt that as every year passes more and more end-users are investigating using networked video solutions for their surveillance needs and more and more tenders are being issued that specify digital video encoding equipment (or codecs) for CCTV applications. From the different vendors in this market one can see that this technology is now applied in a wide variety of different application areas including, airports, rail systems, roads, retailers, casinos, city centres, seaports, and many more. This market is growing steadily but for every single networked video surveillance project, there are still many more that are staying with tried and tested analogue technology. To understand the challenges of this new codec market we must understand a little more about the existing analogue market.

The analogue CCTV market has existed in its current form for about thirty years, meaning it is very mature and reasonably competitive. The market is really dominated by the manufacturers of the cameras and the analogue matrix switches, which are the core element of any CCTV system. This market has changed little in the last few decades except for continuing technical advances in camera technology. This means that product margins for everyone are increasingly thin because technological advances have yielded few efficiency savings. The other main players in the market are the installers and integrators who can range from one man with a van to multi-national organisations. Now enter the network solution.

Codec technology replaces the video matrix with a digital network using conventional IP switching (or router) technology. This has opened up the possibility of combining video over IP for CCTV with other applications. We have now seen the growth of a number of new codec manufacturers (e.g. VCS, Mobotix, Impath) and this market has attracted the interest of the network equipment providers and integrators like Cisco and Telindus. It has also shaken up the conventional analogue players, some of who have reacted by inventing their own codec and IP camera technology (e.g. Sony) and some who have chosen to acquire it. The Bosch acquisition of VCS last year and the more recent acquisition of VisioWave by GE are both recent examples.

The financial argument behind these acquisitions is interesting. It seems clear that it is possible for a codec manufacturer to sell codec equipment at a healthy margin (30-40% hopefully). The integrator or installer can also make margin although it can be as low as 10% and so their focus is being pushed more towards the delivery of integration services. What is challenging for this market is that the technology development costs are still high and the actual sales volumes are still relatively low. Recent market research would point to an annual market growth of 40-50% in the codec product market, but this is from a very low baseline; and a growth rate of 300-400% is perhaps what the developers of the technology require to finance their on-going developments. It is for this reason that the smaller companies have pursued larger partners, and why this market will continue to consolidate over the next two to three years. It seems unlikely that there will be any independent "codec only" companies left by the end of 2008.

The financial argument behind these acquisitions is interesting. It seems clear that it is possible for a codec manufacturer to sell codec equipment at a healthy margin (30-40% hopefully). The integrator or installer can also make margin although it can be as low as 10% and so their focus is being pushed more towards the delivery of integration services. What is challenging for this market is that the technology development costs are still high and the actual sales volumes are still relatively low. Recent market research would point to an annual market growth of 40-50% in the codec product market, but this is from a very low baseline; and a growth rate of 300-400% is perhaps what the developers of the technology require to finance their on-going developments. It is for this reason that the smaller companies have pursued larger partners, and why this market will continue to consolidate over the next two to three years. It seems unlikely that there will be any independent "codec only" companies left by the end of 2008.

For those that survive there is another obvious challenge of price erosion, like any market, as the technology matures then prices and margins will be driven down. For this reason many of the European players are starting to focus more on software and integration as the more lucrative parts of the solution in the longer term.

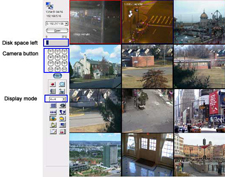

From the end-users' perspective there are a lot of issues with adopting a video over IP solution for video surveillance. The first challenge is that anyone buying into this new technology must be able to understand complex issues in both the analogue CCTV domain and in IT network infrastructure. One of the major frustrations in this market for the end-user is the lack of standardisation around the video transmission process. At the video level the market is standardised on PAL or NTSC video, but this will move to higher definition formats once these are available. At network level most systems are IP and some larger systems are still ATM, and at video compression levels most vendors have settled on video standards like JPEG or MPEG 2 & MPEG 4; however there is no standard process to manage video connections and video streams over a digital network. This means that most systems use a proprietary control mechanism or the lowest common denominator for network systems, http- the messaging protocol used for websites to manage video connections.

The Internet has driven standardisation in the playback of video (e.g. Real Time Streaming Protocol or RTSP) but this is not really suitable for live video transmission. In the access control and building automation markets the OPC standard is a suitable protocol, which allows different sensors and systems from different vendors to interoperate in one solution. An OPC equivalent for video transmission is urgently required to make life easier for end-users and manufacturers.

The second major challenge for the end-user is that once they have decided to use an IP video surveillance system they must then deal with security of that network. This is where working with a network integrator, rather than a surveillance specialist, becomes a real advantage. In many ways the demands of network security for video information are no greater than for securing personal data, banking records, medical reports and sensitive corporate information so the networking technology which is available to provide security for these types of information can be harnessed for video surveillance.

The second major challenge for the end-user is that once they have decided to use an IP video surveillance system they must then deal with security of that network. This is where working with a network integrator, rather than a surveillance specialist, becomes a real advantage. In many ways the demands of network security for video information are no greater than for securing personal data, banking records, medical reports and sensitive corporate information so the networking technology which is available to provide security for these types of information can be harnessed for video surveillance.

The real challenge to the end-user is that a network solution comes with some significant risks. There will always be a lower risk solution based on analogue technology that may have a lower upfront cost.

Risks

- Market development - smaller codec vendors are at risk from financial collapse.

- Standards - proprietary technology can leave the end-user with an un-maintainable system.

- Product development - Technology can change rapidly making a newly installed system obsolete overnight.

The disadvantage of letting these risks dominate the decision is that it removes the likely benefits that can be obtained by moving to a network based surveillance solution.

Benefits

-

Flexibility - adding an additional camera to an installed CCTV system is as easy as adding a new PC to an existing network. In many cases the only additional hardware will be the new camera and only minimal reconfiguration will be required from the management side.

Flexibility - adding an additional camera to an installed CCTV system is as easy as adding a new PC to an existing network. In many cases the only additional hardware will be the new camera and only minimal reconfiguration will be required from the management side. - Resilience - a digital network supports many different paths for video and other data. In the analogue world coax runs point-to-point and a single break in that path will stop the video transmission.

- Increased functionality - by using a network based solution the surveillance system can be integrated with access control, buildings management and other image analysis systems. This allows the user to respond to a single event knowing all the information they require.

- Operational efficiency - a network solution allows one operator to view all the video from anywhere on the network. This means that some control rooms can be closed at quiet periods and monitoring can continue from another location.

So are we there yet? If the end-user is prepared to accept a little risk, in return for a reasonable reward, and they are able to find a suitable network partner then for that end-user, yes, we are there; however, overall it still seems that we still have some way to go.